How Long Will It Take To Sell Your House?

As you’re getting ready to sell your house, one of the first questions you’re probably asking is, “how long is this going to take?” And that makes sense—you want to know what to expect.While every market is different, understanding what’s happening nationally can give you a good baseline. But for an even more detailed look at real estate conditions in your area, connect with a local real estate agent. They know your local market best and can explain what’s happening near you and how it compares to national trends.Here’s a look at some of the things a great agent will walk you through during that conversation.More Homes Are on the Market, and That’s Affecting How Long They Take To SellAccording to Realtor.com, the number of homes for sale has been going up this year. That means there are more options for buyers, which is great news for anyone looking to buy a home. But as a seller, it also means homes are staying on the market a bit longer now that buyers have more options to choose from (see graph below):One of the big reasons homes sold so fast in recent years is because there were so few of them for sale. And now that there are more houses on the market, it makes sense that they aren’t selling at quite the same pace. Right now, according to Realtor.com, it takes 55 days from the time a house is listed for it to be officially sold and closed on.But keep this in mind. While homes might not be selling as quickly as they did last year at this time, they’re still selling faster than they did in more normal years in the housing market, before the pandemic.If you look back at 2017-2019 in the graph above, you’ll see that it was typical for a house to take 60 days or more to sell. So, today’s process is still faster than the norm.That’s because, even with more homes for sale, there are still more buyers than homes for sale. So, homes that show well and are priced right are selling fast. As NerdWallet explains:“Overall, though, demand still outpaces supply. This is hardly a mellow market: Good homes sell quickly . . .”Your Agent Can Help Your Home Stand OutIf you’re looking for ways to make your move happen as quickly as possible, partnering with a great local agent is the key. Your real estate agent will help you with everything from setting the right price to staging your home so it looks its best. They’ll even create a marketing plan that grabs buyers’ attention and will give you key insights about what’s happening in your specific area, so you can plan accordingly and make the process go as smoothly as possible.So, while homes might be on the market a little longer than before, they’re still selling faster than the norm. If you have the right agent and the right strategy in place, your house may even sell faster than you’d expect.Bottom LineIf you’re planning to sell your house, knowing how long it might take is a big part of planning your next steps. Let’s connect so you’ll be able to price, market, and sell your home with confidence. Reach me at https://linktr.ee/brianeastwoodrealtor. It can be overwhelming, but I’m here to help.

What To Expect from Mortgage Rates and Home Prices in 2025

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices.Whether you're thinking of buying or selling, here’s a look at what the experts are saying and how it might impact your move.Mortgage Rates Are Forecast To Come DownOne of the biggest factors likely affecting your plans is mortgage rates, and the forecast looks positive. After rising dramatically in recent years, experts project rates will ease slightly throughout the course of 2025 (see graph below):While that decline won’t be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they’re released. But don’t get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.Lower mortgage rates mean improving affordability. As rates come down, your monthly mortgage payment decreases, giving you more flexibility in what you can afford if you buy a home.This shift will likely bring more buyers and sellers back into the market, though. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, explains:“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.”As that happens, both inventory and competition among buyers will ramp back up. The takeaway? You can get ahead of that competition now. Lean on your agent to make sure you understand how the shifts in rates are impacting demand in your area.Home Price Projections Show Modest GrowthWhile mortgage rates are expected to come down slightly, home prices are forecast to rise—but at a much more moderate pace than the market has seen in recent years.Experts are saying home prices will grow by an average of about 2.5% nationally in 2025 (see graph below): This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets. What’s behind this ongoing increase in prices? Again, it has to do with demand. As more buyers return to the market, demand will rise – but so will supply as sellers feel less rate-locked. More buyers in markets with inventory that’s still below the norm will put upward pressure on prices. But with more homes likely to be listed, supply will help keep price growth in check. This means that while prices will rise, they’ll do so at a healthier, more sustainable pace. Of course, these national trends may not reflect exactly what’s happening in your local market. Some areas might see faster price growth, while others could see slower gains. As Lance Lambert, Co-Founder of ResiClub, says:“Even if the average national home price forecast for 2025 is correct, it’s possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.” Even the few markets that may see flat or slightly lower prices in 2025 have had so much appreciation in recent years – it may not have a big impact. That’s why it’s important to work with a local real estate expert who can give you a clear picture of what’s happening where you’re looking to buy or sell.Bottomline: With mortgage rates expected to ease and home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers. If you have any questions about how these trends might impact your plans, let’s connect. That way you’ve got someone to help you navigate the market and make the most of the opportunities ahead. Reach me at https://linktr.ee/brianeastwoodrealtor. It can be overwhelming, but I’m here to help.

Buyers: Fed Reserve Drops Rate, Buyer Contracts Increase Sellers: Mixed Emotions for Housing on Positive Jobs Reports

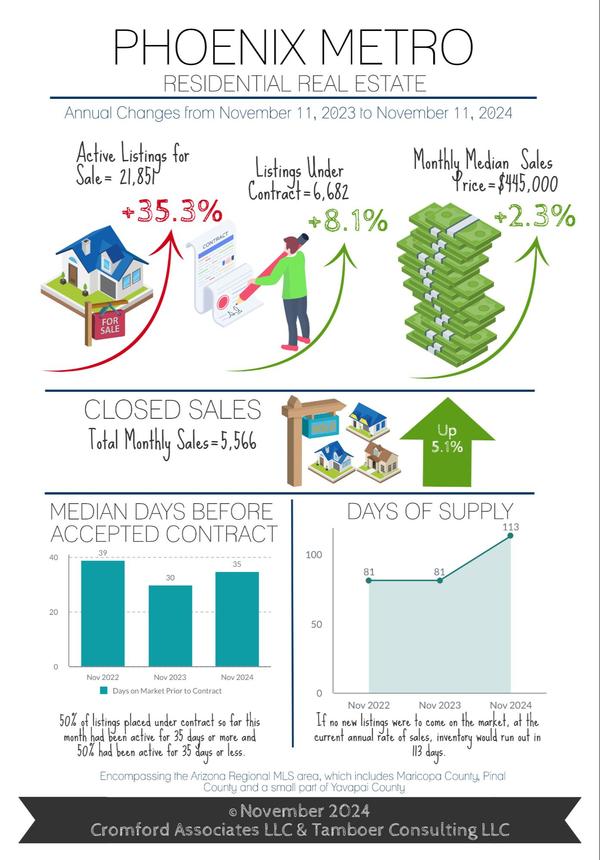

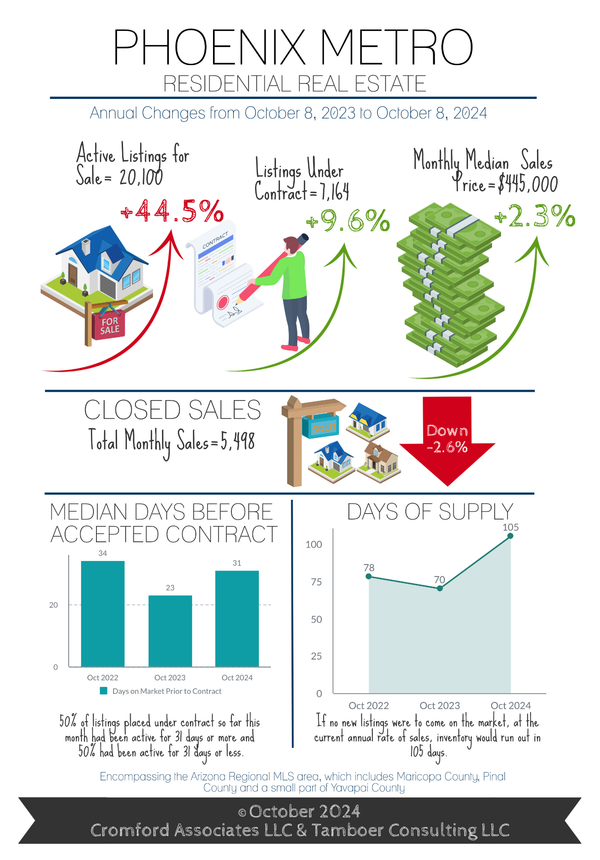

It's been another crazy month for interest rates. The Federal Reserve dropped rates in September and we saw a long awaited drop in mortgage rates - but more favorable economic news in the Jobs Report gave an indication that there may be fewer cuts later this year so they jumped back up again. At the end of the day, positive notes abound for both buyers and sellers. Inventory is increasing which means there are more homes to choose from and a stronger ability to negotiate favorable terms to buy down rates well below the current market. On the seller side, more buyers are starting to re-enter the market in anticipation of increased competition. But, don't just take my word for it, hear what our smart economists at the Cromford Report have to say about each segment, and as we approach market balance - let's have a solid plan in place whether your goal is to buy or sell; let's get the most value for you no matter what your goal. For Buyers:For the first time all year, listings under contract are higher than they were last year at this time. Over 4 straight weeks in September, average conventional mortgage rates stabilized roughly between 6.1%-6.2%, and 5.6%-5.7% for FHA, which was the sweet spot for buyers to mobilize. Weekly accepted contracts increased 12% during that time frame, confirming expectations that conventional rates need to be sub-6.5% to see a meaningful shift in buyer demand.Some believe the rates declined as a result of the Federal Reserve reducing the Federal Funds Rate by 0.5pt on September 18th, but mortgage rates had already dropped in anticipation of the Reserve’s actions. It was the follow through of that anticipation that gave consumers the certainty to act and gave the industry hope that relief was on the way.As the 4th quarter begins, the housing environment for buyers is the most favorable its been since December 2022, when there were more than 20,000 active listings in the MLS and a weekly average of 6,148 listings under contract. Back then, mortgage rates had also dropped below 6.5% and hovered between 6.1%-6.5% for 2.5 months. This October, mortgage rates are once again hanging in the mid-to-low 6% range, increasing buyer demand at a time when active listing counts are over 20,000 in the MLS.Seasonally, this is the best time to be a buyer in Greater Phoenix. It’s typical to see active listings rise as weekly accepted contracts decline, giving existing buyers lots of homes to choose from and fewer competitors. Seasonally adjusted measures, like the Cromford Market Index are showing a market in balance, indicating very little fluctuation in price measures in either direction. In this environment, every drop in the mortgage rate means all properties go on sale.Greater Phoenix has only seen a market this favorable for buyers twice in the last decade, and both times the opportunity was fleeting; lasting only 9 weeks in 2022 and 5 weeks in 2014. For Sellers: While conventional mortgage rates were in the low-6% range for 4 weeks, they popped up to the mid-6% range after the release of a positive employment report citing a decline in the unemployment rate and an increase in wages. The report, while positive, caused disappointment and uncertainty for those anticipating further rate cuts by the Federal Reserve, which indirectly could further improve mortgage rates and housing demand for sellers.It’s not uncommon for mortgage rates to bounce up a little after significant drops, so it may only be temporary as rates are expected to glide down over the next year. In the meantime, only serious sellers need apply in this market with a slight buyer advantage. With a high count of competing listings for sale, property condition should be a top priority. Gone are the days of simply dropping the price for a less-than-perfect home, or offering a carpet allowance. Small jobs such as replacing carpet, deep-cleaning grout, or brightening up a living room with paint or lighting can make a huge difference in creating a positive first impression on buyers who may not have the funds, the time, nor the desire to do home projects.Properties listed between $275K-$500K should also budget for incentives to the buyer and longer marketing times over the holidays. More than 62% of sales in this price range close with $8,000-$10,000 in closing cost assistance from sellers that typically contribute to temporary mortgage rate relief. This may be a stretch for those sellers who have only owned their home for 2-3 years as property appreciation has been flat year-over-year since September 2022, providing little equity to accommodate the added expense. Sellers who have owned for at least 3 years or more have more flexibility to provide buyer incentives.Seasonally, the first half of the year is the best time for sellers in Greater Phoenix as buyer demand rises in the 1st quarter and peaks in the 2nd, tourism is at its peak and marketing times decrease. If mortgage rates decline in 2025 as many lending outlets predict, the Spring season could outperform the last two years as suppressed demand returns.

Recent Posts