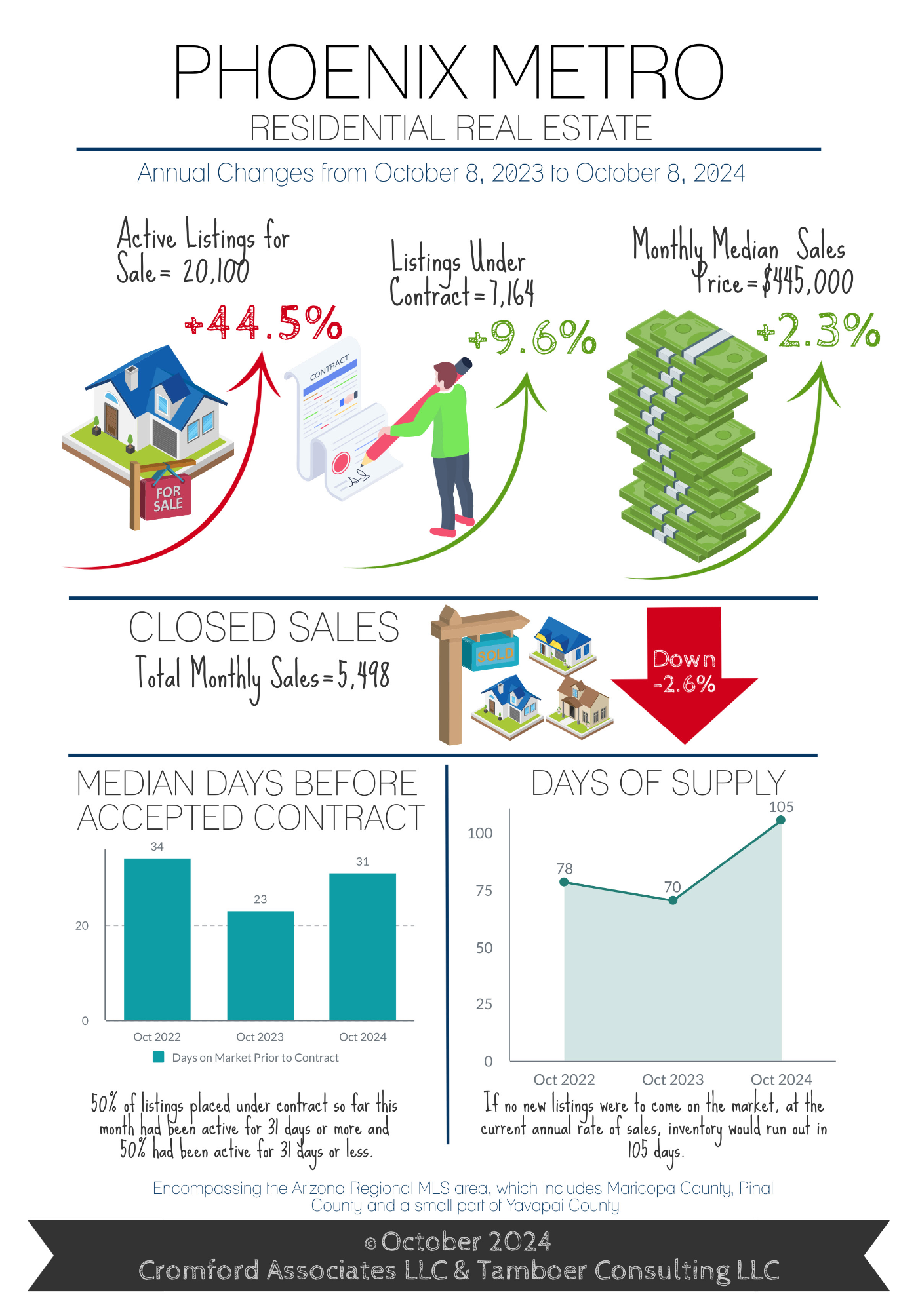

Buyers: Fed Reserve Drops Rate, Buyer Contracts Increase Sellers: Mixed Emotions for Housing on Positive Jobs Reports

It's been another crazy month for interest rates. The Federal Reserve dropped rates in September and we saw a long awaited drop in mortgage rates - but more favorable economic news in the Jobs Report gave an indication that there may be fewer cuts later this year so they jumped back up again. At th

Home Values Rise Even as Median Prices Fall

Recent headlines have been buzzing about the median asking price of homes dropping compared to last year, and that’s sparked plenty of confusion. And as a buyer or seller, it’s easy to assume that means prices are coming down. But here’s the catch: those numbers don’t tell the full story.Nationally,

Why Buying Now May Be Worth It in the Long Run

Should you buy a home now or should you wait? That’s a question a lot of people have these days. And while what’s right for you is going to depend on a lot of different factors, here’s something you’ll want to consider as you make your decision.As soon as you buy, you’ll start gaining equity. And yo

Recent Posts