Expert Forecasts for the 2025 Housing Market

Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.Experts are constantly updating and revising their forecasts, so here’s the latest on two of the

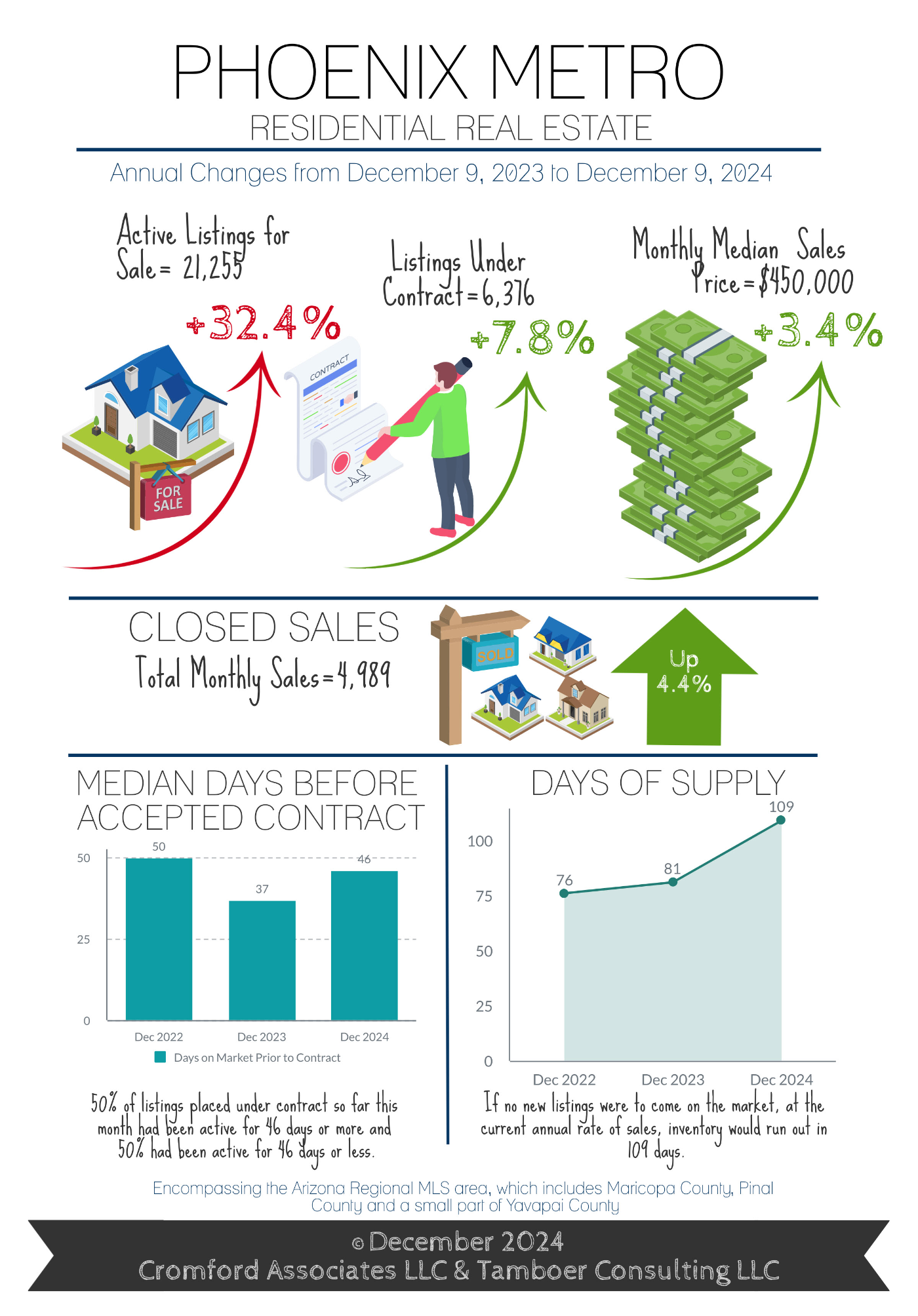

Predictions for 2025, What to Expect in Q1 and It's a Buyer's Market, Will Prices Drop?

The 2024 housing market has been nothing less than unpredictable. This Fall things have stabilized a bit, purchasing activity is up slightly, as is inventory - buyer's finally have a slight advantage, but it's looking like January through Spring time will bring another boom to the Valley. But, don

What Will It Take for Prices To Come Down?

You may be wondering if home prices are going to crash. And believe it or not, some people might even be hoping this happens so they can finally purchase a more affordable home. But experts agree that's not what's in the cards – and here's why.There are more people who want to buy a home than there

Recent Posts