When will interest rates fall — and how fast?

Mortgage applications are up by 25% with only slight rate changes. When will rates fall and how fast, hear what this economist has to say.

When will interest rates fall — and how fast?

by Russell Price, Chief Economist – Ameriprise Financial

The direction of interest rates will undoubtedly be one of the most important and closely watched economic indicators of 2024. And now that inflation is subsiding, it seems as though it’s no longer a question of if the Federal Reserve will cut interest rates — but when and how.

Here’s our interest rate outlook for 2024:

Will the Federal Reserve lower interest rates in 2024?

The Federal Reserve is expected to begin lowering interest rates this year as inflation further subsides. After reaching a high of 9.0% in June 2022, inflation (as measured by the Consumer Price Index) has steadily declined, ending 2023 at 3.4%.

Further progress is expected over the months ahead and we believe inflation should near the Fed’s target of “about 2%” by the middle of this year. Consumers should not expect to see outright price declines for most products or services, but the pace of price increases should return to the modest rates seen pre-pandemic, of just under 2% per year on average.

When might Fed officials start to cut rates?

If inflation is brought under control as we expect, it should enable Fed officials to begin lowering their overnight lending rate, the Fed funds rate, by the second quarter. Some estimates, however, look for the first Fed rate cut to come as early as March.

From a starting point near zero, the Fed began raising interest rates aggressively in March 2022. The higher rates were intended to slow economic activity as to mitigate inflation pressures. Officials last hiked rates at their July 2023 meeting when they boosted the fed funds target range to 5.25% – 5.50%.

How fast may rates decline?

As of this writing, Fed fund futures as traded on the CME indicate market expectations for approximately six quarter-point (25 basis points) rate cuts this year, which would bring the mid-point of the Fed’s target range down to about 3.85%. This is considerably more aggressive than the Fed’s own indications. In their December Summary of Economic Projections (SEP) report, Fed officials were shown to believe approximately three, quarter-percent cuts this year as likely.

How will the Fed’s actions impact consumer borrowing?

Federal Reserve interest rate actions do not always result in one-for-one changes in consumer borrowing costs, such as mortgage or auto loan rates. Such rates are primarily related to longer-term interest rate benchmarks, particularly the yield on the 10-year Treasury, which results from financial market trading activity.

At the time of this writing, the yield on the 10-year Treasury is already well off its recent highs in anticipation of this year’s expected Fed moves. At the end of January, the yield on the 10-year Treasury was approximately one percentage point lower than its recent high of 5.0% as attained Oct. 31, 2023.

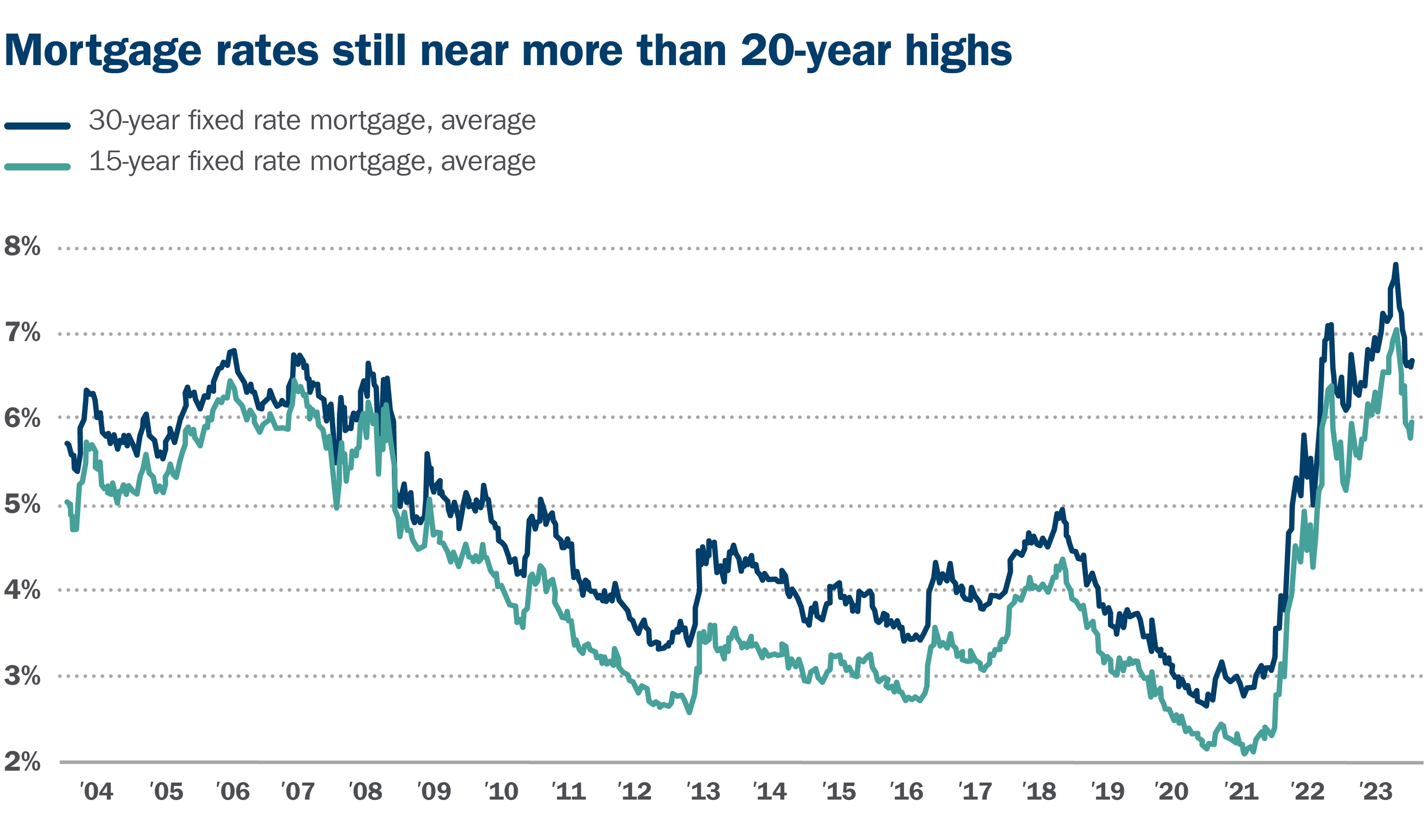

Likewise, 30- and 15-year mortgage rates are also about one percentage point lower relative to their recent highs. Currently, the national average 30-year fixed mortgage rate is 6.6%, according to the Mortgage Bankers Association (MBA). We believe mortgage rates could decline by another half-a-percent or so this year.

How will interest rate cuts impact the broader economy?

Sectors of the economy that are sensitive to interest rates, particularly the housing market, should see the greatest benefit from lower rates, just as they suffered the most when rates were rising.

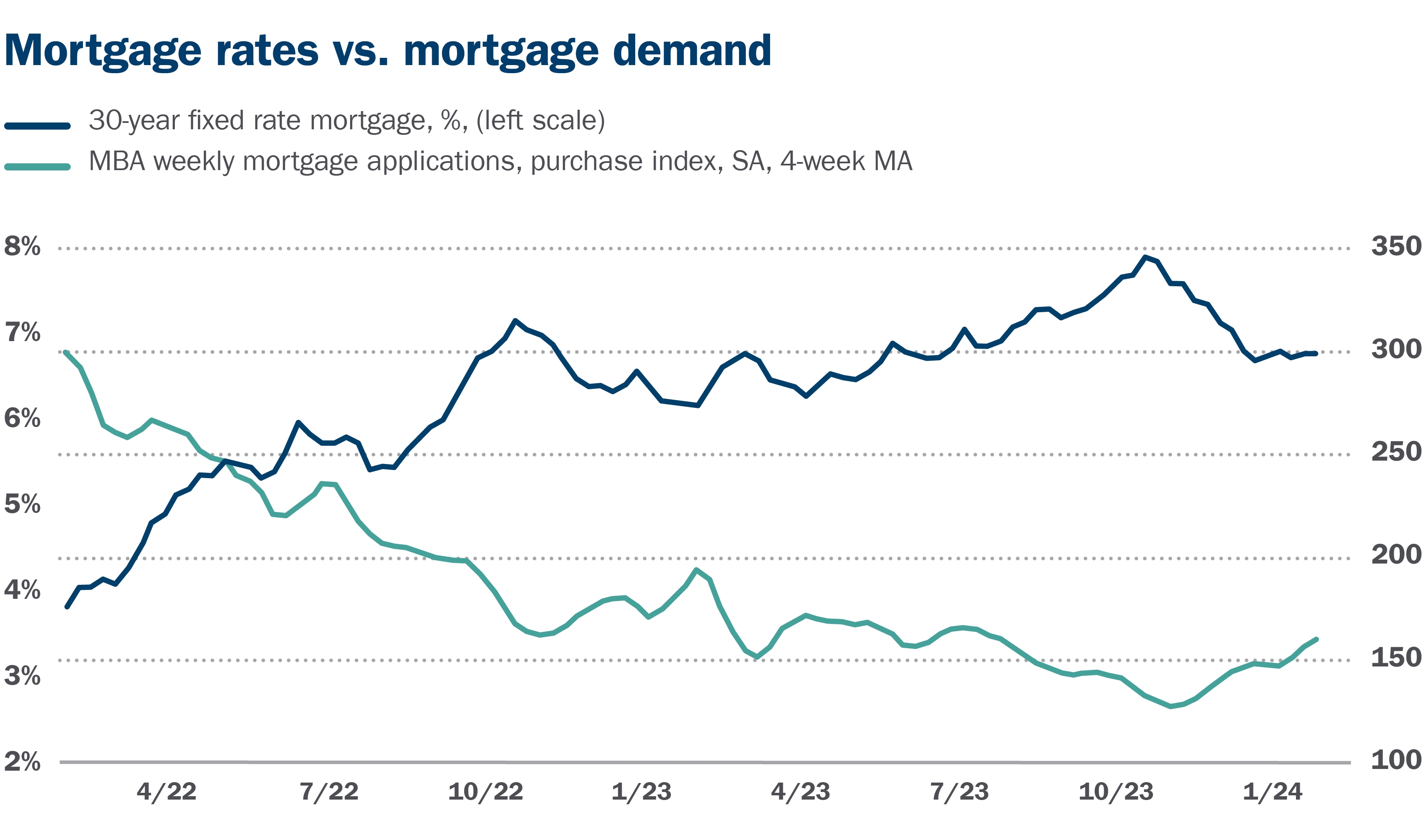

Prospective homebuyers have responded to the decline in mortgage rates seen so far. Mortgage applications related to the purchase of a property were up 25% through the end of January relative to the end of October, according to the MBA.

Finally, just as rising interest rates were a strong headwind for stock and bond performance in 2022, declining interest rates have historically been a tailwind. Lower rates typically lead to stronger borrowing and spending which can boost economic activity. Lower rates can also boost bond returns as bond rates and bond prices move inversely.

Bottom line

Barring a reversal in inflationary pressures, the Federal Reserve is well positioned to cut interest rates by the middle of 2024. Let’s connect if you have any questions about what you’re reading or hearing about the housing market. Reach me at https://linktr.ee/brianeastwoodrealtor to jumpstart your journey. It can be overwhelming, but I’m here to help.

Recent Posts