Sellers: Condition of Your Home Matters Today

Delays in interest rate reductions have slowed buyer demand in what is normally one of our busiest seasons. Rates aside there are still compelling reasons for buyers to capitalize on today’s market: motivated sellers mean there are better conditions to maximize seller credits towards permanent rate buy-downs, closing costs, etc. But, as the folks over at The Cromford Report discuss below – owning a home and the payment associated with it actually sits below market inflation – providing a payment below the norm for today’s market and the ability to capitalize on future equity gains.

For Sellers:

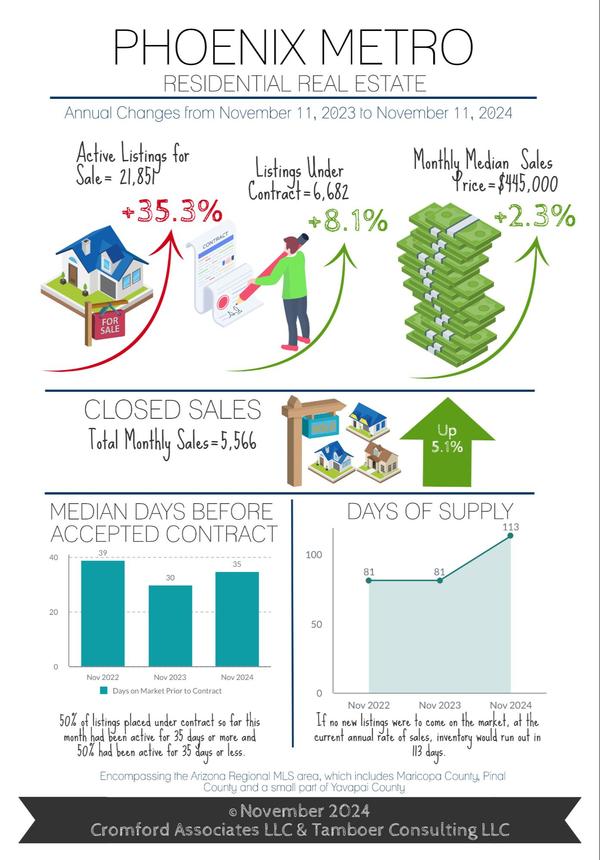

It’s the peak Spring buying season in Greater Phoenix, although it may not feel like it for some sellers. The housing market has begun to drift towards another balanced state over the past 4 weeks, which is the result of an accumulation of supply as demand remains weak. Listings under contract are only down 6% compared to last year, but active listings are up 26%. Days prior to an accepted contract would be 3 weeks at this time of year normally, but current conditions are adding an extra week for sellers.

Word on the street is resale homes needing to be remodeled or updated are sitting a bit longer as builders are ramping up permits for new homes. In fact, single family permit activity is up 125% year over year for January and February and-new home sales are up 16%, surpassing 2021 (the previous 10-year high mark). The competition isn’t just for the sub $500K market either. Luxury new home sales over $3M are up 79% so far this year and up 28% between $1M-$3M.

The struggle for resale listings that need paint, carpet, or significant changes is that fewer traditional buyers have the capacity to finance a remodeling project with current rates, or they may not be able to visualize the space any other way, or they may think the cost and time for basic renovations is greater than it is. As far as investor purchases go, wholesale offers are due to get uglier with increased holding costs, stagnating monthly appreciation, and smaller returns. Flip sales are down 74% from 2 years ago and at a level comparable to 2015.

Whether it’s getting quotes for work, renditions to help with visualization, or advising the seller on the most important updates to make prior to listing, it’s markets like this where professional representation and feedback makes a difference for both sellers and buyers. Despite current challenges, sellers are averaging 97.8% of their last list price at close of escrow so far this month. Seller-paid closing-cost assistance is down 2% to 44% of sales, and the median sales price increased to $444,900, up 6% from last year.

As always, if you have any questions, reach out to me for help and guidance. if you have any questions, reach out to me for help and guidance. Connect with me through https://linktr.ee/brianeastwoodrealtor 🙌

Recent Posts